Professional Tax Registration in HRBR Layout

Are you running a business or working as a professional in HRBR Layout? If yes, then you must do Professional Tax Registration in HRBR Layout. It is a tax charged by the state government. It applies to people who earn money through jobs, businesses, or their profession.

If you are a company owner or an individual earning from work, you must register. Not doing this on time can lead to fines or legal issues.

Bizivalue helps you register easily and quickly. We manage everything—from collecting documents to submitting forms. You do not have to worry about mistakes or delays. Whether you are starting a new company or running an existing one, we guide you step by step.

Online Professional Tax Registration in HRBR Layout

Want to register for professional tax without going to any office? Choose Online Professional Tax Registration in HRBR Layout with Bizivalue. The entire process is done through the internet. You don’t need to go anywhere or fill confusing forms.

Our expert team takes care of everything for you. We help you complete your registration from home or your office. The process is fast, safe, and simple. We check all your details and documents carefully before sending them. This helps you get approval without any delay.

Profession Tax Return Filing in HRBR Layout

After you register, you must do Profession Tax Return Filing in HRBR Layout. If you have employees, you must file returns every month or quarter. This means you must report how much tax was taken from salaries and pay it to the government.

If you do not file on time, you may have to pay a fine. Bizivalue helps you file these returns correctly and on time. We calculate how much tax is due, fill out the forms, and submit them for you. This helps your business stay legal and avoid problems.

Benefits

Professional Tax Application in HRBR Layout

Filing the Professional Tax Application in HRBR Layout is the first step to follow the rules. If you earn money through business or work, you must apply. This includes companies, professionals, shop owners, and freelancers.

You need to fill forms and send ID proofs to the tax office. Bizivalue helps you understand everything and fills the forms correctly. We also make sure you are in the right tax category. This saves you from errors and delays.

Professional Tax Enrollment in HRBR Layout

If you are a professional, freelancer, or business owner, you need to get Professional Tax Enrollment in HRBR Layout. This is a must under Karnataka rules. After enrollment, you will get a PTEC (Professional Tax Enrollment Certificate).

We help you apply for this certificate with all correct documents. Our team explains how much tax you need to pay every year. You will not miss any deadlines. Bizivalue makes sure you complete your enrollment without trouble.

Professional Tax Registration for Company in HRBR Layout

Have you started a company and hired employees? If yes, you must do Professional Tax Registration for a Company in HRBR Layout. You must register within 30 days after hiring staff. The company has to deduct tax from employees’ salaries and pay it to the state.

Bizivalue helps you get both the PTRC (Professional Tax Registration Certificate) and PTEC. We also help you understand your duties and how often you need to file. Our team ensures your company follows all the rules and avoids penalties.

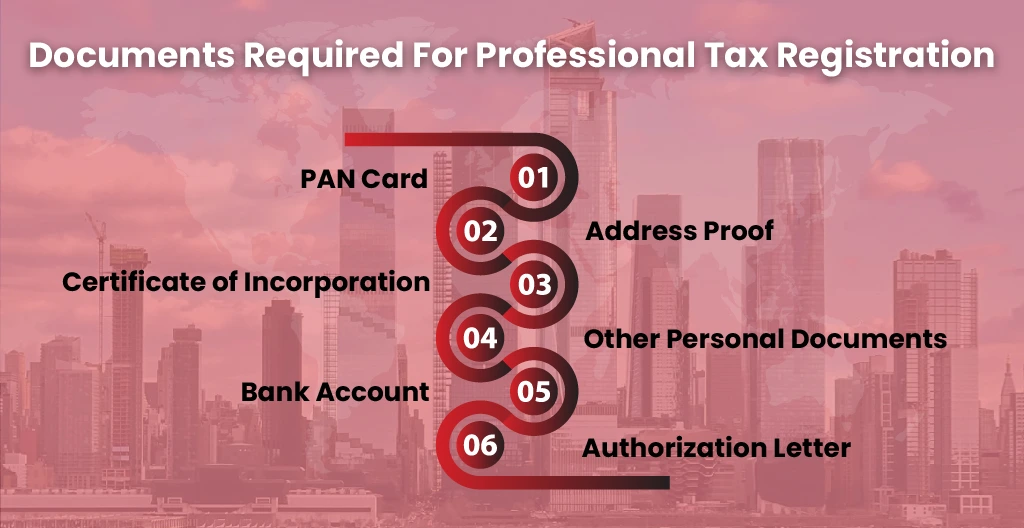

Documents Required

To register or enroll for professional tax in HRBR Layout, you need to give some important documents. These help to confirm your identity, address, and business type.

You will need:

PAN card of the company or owner

Aadhaar card or voter ID of the owner or director

Proof of office address like an electricity bill or rent agreement

Details of employees and their salaries

Passport-size photo

Mobile number and email address

We help you collect these documents and check if they are correct. This makes your registration smooth and fast.

Why Choose Bizivalue?

It is important to choose the right team to help you register and file professional tax. Here is why many people trust Bizivalue for professional tax work in HRBR Layout:

Full online support from start to finish

Low-cost services with no hidden charges

Fast process and regular updates

Help with return filing, renewals, and staying legal

Friendly support for startups, freelancers, and growing companies

We manage the whole process so that you can focus on your business.

Contact Us

Want help with professional tax in HRBR Layout? Let Bizivalue take care of everything. We help you apply, register, and file your returns easily. You don’t have to deal with forms or worry about missing deadlines.

Contact us today to get started. We’ll help you stay legal and stress-free.

Free Cost Calculator

Our Services

- Private Limited Company

- One person company

- Limited Liability Partnership

- Startup Registration

- Public Limited Registration

- NGO Registration

- Producer Company

- OSP License

- GST registration

- FSSAI registration

- Partnership firm

- Proprietarship firm

- Nidhi company

- Trademark Registration

- Copyright Registration

- Manage Your Accounts

- Private Limited Company Closure

- One Person Company Closure

- Limited Liability Partnership Company Closure

- Partnership to LLP

- Proprietorship to pvt ltd

- Pvt ltd to public limited

- Pvt ltd company to one person

- Pvt ltd roc compliance amc

- OPC roc compliance amc

- LLP roc compliance amc

- DIR3 din kc filing

- ROC return filings for pvt ltd

- ROC return filing for llp

- ROC return filing for llp

- Increase in authorized capital

- Add a director

- Remove a director

- Office address change

- GST filling

- Professional tax registration

- TDS returns

- Pf registration

- ESI registration

- Income tax return

- Shop establishment regulation

- SSI msme registration

- Importer exporter code

- ISO Certification

Frequently Asked Questions

Yes, it is mandatory for businesses and professionals earning income in Karnataka. Not registering can lead to penalties.

Employers with salaried staff must file monthly or quarterly returns. Self-employed professionals may need to file annually.

PTRC is for employers deducting tax from salaries. PTEC is for professionals or businesses paying their own tax.

With correct documents, registration usually takes 5 to 7 working days. Delays can happen if information is incomplete.

Yes, the entire process can be completed online. Our experts handle the full registration for you.

Bizivalue offers fast, affordable, and expert support. We help you register, file returns, and stay fully compliant.