Businesses Served

Customer Ratings

Metropolitan Cities

Satisfaction Guaranteed

Welcome to BIZIVALUE

Compliance Simplified

We are your trusted partner who eases your foray into India. Be it a new venture or a subsidiary company, we offer professional corporate services that make a difference to your business top- and bottom-line. Bizivalue serves across India with offices located in major metropolitan cities.

We are India’s leading platform providing Consulting as service for Compliance to startups

- Best Quality With Affordable Pricing

- Virtual Service Platform

- High standards of integrity

- Experienced Taxation Team

- Swift Customer Support

- 4.4 Rated on Google

100+ Service Offering

We offer over 100 plus services for companies under one brand, making it cost efficient & Hassle-free.

Qualified & Experienced

We deliver unmatched quality in our compliance services because of a highly qualified and experienced Team.

Professional Consulting Company

Empowering Startups under the Initiative of Make in India

Why do customers love us?

- Affordable Professional Services

- Diverse Expert Network

- Easy-to-use dashboard

- Quick Customer Support

Our Services

Avail Over 100+ Professional Services At Bizivalue

- Company Registration

- Trademark & IPR services

- ROC Filing

- Other Registration

- STARTUP INDIA | ISO | MSME

Pvt. Ltd. Registration

Private limited company is popular and well known business structure it enjoys wide options to raise funds through bank loans, angel investors, venture capitalists, in comparison to LLPs and OPCs.

OPC Registration

The one person company helps startup entrepreneurs they can approach angel investors, venture capitalists for funding and easily convert their OPC into multi shareholder private limited company.

LLP Registration

Limited liability partnership is the modern business option for traditional firms operating as partnership. Limited Liability Partnership (LLP) combines the benefits of a partnership with that of a limited liability company.

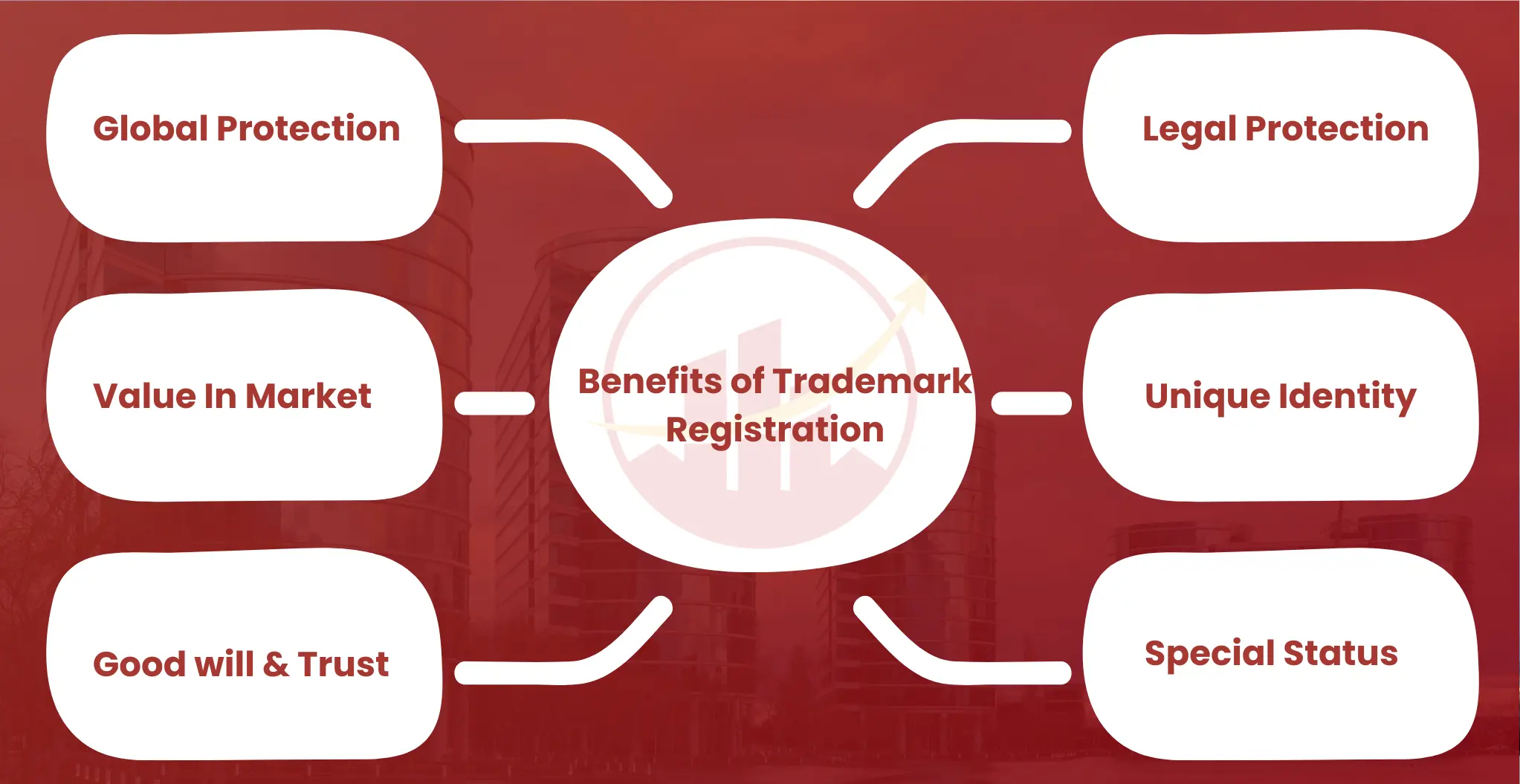

Trademark Registration

Nobody will dare to copy your brand name once it is a registered trademark.

Copyright Registration

Copyright is an important property of the owner. Copyright protects from copycats.

ROC Return Filing for Pvt. Ltd. Company

ROC return gives details of changes taken place in the company during the year and need to be filed with the ROC even though the company has not done any business during the year.

Our Partners Benefit From

Expertise in Registrations & Compliance.

Earn Money & Peace of Mind while we work in the background for you.

Most trusted Partner for 1000+ Startups

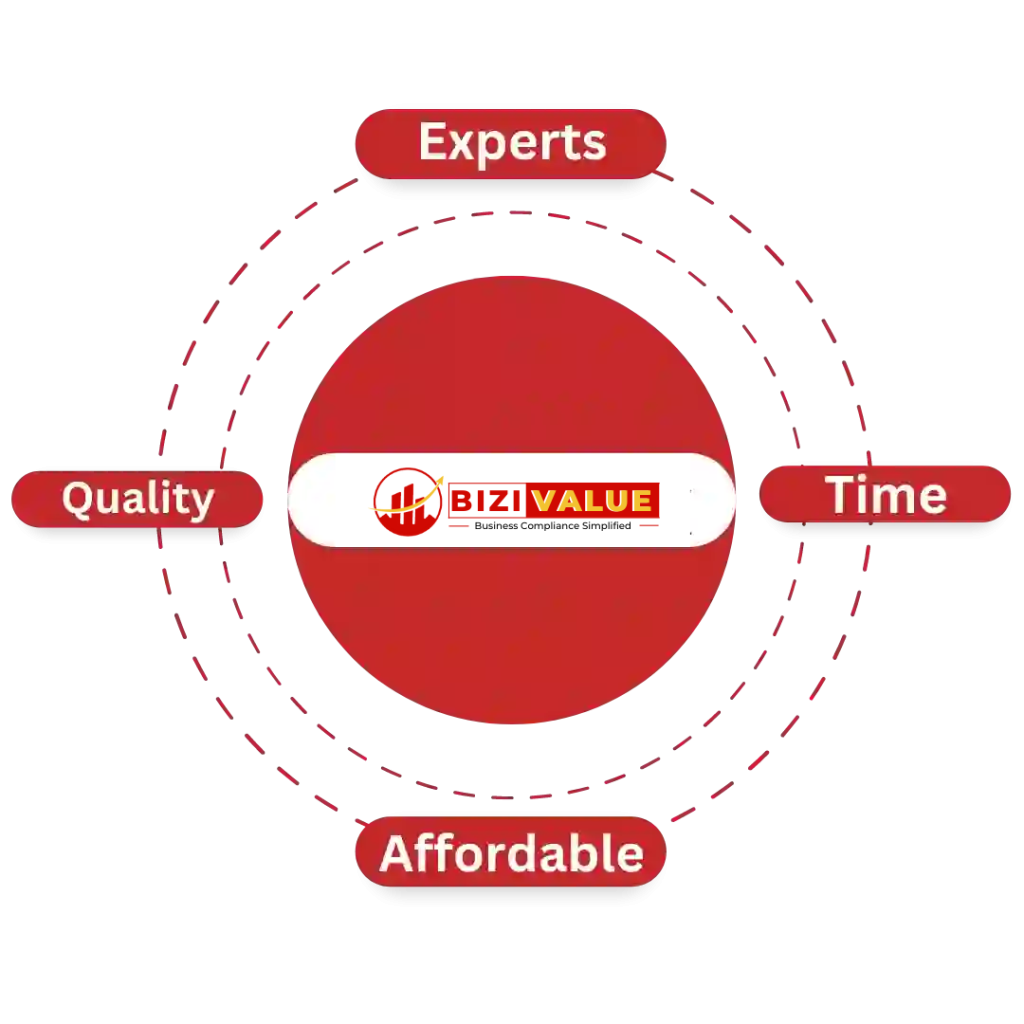

Why Choose Bizivalue?

Our quality of work will fetch you what you are looking for and thus return on investment is always promising from our End

All our experts have a great sense of ISO and other international standards with multiple years of experience

We believe in improving the bottom-line of the customers and help them to get best out of the implementation process.

Our consultant work 24/7 and all 365 days to respond to our customer requirement

immediately and are always available to respond to their queries

Our scope of project completion includes stipulated time-frame, cost effective and best quality with high end commitment of our consulting team

India’s corporate services provider to be ISO 9001 certified

Experienced and multinational qualified team of professional to serve you

End-to-End solutions for clients expanding/migrating their business in India

Personalised approach – Just a call away

Qualified professional team

Proven credentials and track record

Pricing transparency with no hidden cost

Frequently Asked Questions

Particulars of the Director's, Manager or Secretary - Form-32. After processing of the Form is complete and Corporate Identity is generated obtain Certificate of Incorporation from RoC. File a declaration in eForm 19 and attach the prospectus (Schedule II) to it. Obtain the Certificate of Commencement of Business.

To obtain this, you need a valid mobile number (an India number), email address and PAN (Permanent Account Number) for the business. Go to official GST portal - https://www.gst.gov.in/ and under the services tab, choose Services > Registration > New Registration

So, what exactly is the PF process? According to the EPF rules, 12 percent of your salary must go towards your provident fund. Your company is also required to contribute the same 12 percent, out of which 8.33 percent of the salary is directed towards the Employee Pension Scheme or EPS.

To obtain this, you need a valid mobile number (an India number), email address and PAN (Permanent Account Number) for the business. Go to official GST portal - https://www.gst.gov.in/ and under the services tab, choose Services > Registration > New Registration

So, what exactly is the PF process? According to the EPF rules, 12 percent of your salary must go towards your provident fund. Your company is also required to contribute the same 12 percent, out of which 8.33 percent of the salary is directed towards the Employee Pension Scheme or EPS.

Why Brands Rely On Our Expertise

We ensure that only the best of the consulting experience is given to our clients